Powered Up

Or why elections in 2024 were good ones to win

It’s a theme I’ve riffed on before, but the last four years have been pretty miserable for consumers in the developed world, largely because commodity prices have risen sharply. And when commodity prices rise, then other prices (but not wages) will follow. Higher natural gas prices mean more expensive electricity, which not only squeezes household budgets, but means that fertilizer is more expensive (the Haber process), making food cost more. Plus your local supermarket is paying more to keep the lights on, so they need to earn a bigger margin to ensure they cover their fixed costs.

If you look at waves of optimism and pessimism in developed world countries, their cycles bear an uncanny resemblance to those commodity price rises. High prices for energy in the 1970s… terrible times for consumers. Low prices in the 1980s and 1990s… great times for consumers.

And when Putin invaded Ukraine, he threw a massive stone into the pool of the world economy, and the waves (higher prices, not wages) have lasted several years.

Well, I’m here to tell you some good news.

The next four years are going to see this trend reversed. Energy is going to be significantly cheaper, and that’s going to put pounds (or dollars) in consumers’ pockets.

And it’s happening for three reasons:

Firstly, higher natural gas prices resulted in new LNG projects getting greenlighted. The most high profile of these are in the US, but there’s also Qatar’s North Field expansion, offshore Mauritania (GTA), Mexico as well as a number of smaller floating LNG projects. 2026 should see a record amount of new natural gas come to the market, and that is going to mean cheaper prices.

Secondly, Russian energy exports will – at some point – resume. Now, this might come about because of the end of the war in Ukraine. But even if that doesn’t happen, Russia will find a way to export gas to countries (like India or China) who care more about importing cheap energy, than they do about supporting Ukraine. And energy is fungible. If the Chinese are importing from Russia, that means they’re not competing with the UK or Germany to import from Australia or Qatar.

Thirdly (and this is the big one), is solar. It’s hard to overstate the impact of solar on energy prices going forward. Simply, solar panels are becoming so cheap that they are going to become ubiquitous. And there is nothing to do with governments or subsidies or anything else. They are simply so cheap to manufacture, that they’re going to be everywhere.

And once a solar panel is installed, it produces zero marginal cost energy whenever light hits it. And the more solar panels there, the more solar energy will be produced. In the last two months, China has installed 44 GW of new solar. To put that in context, UK energy demand right now is 33 GW. Of course, the sun isn’t shining all the time, but if there are enough panels (and given their collapsing price, there will be enough panels), then we will get to a situation where essentially all daytime energy production is from solar. It is inevitable.

Now, there are many interesting investment consequences of this, which I won’t delve into. But the fundamentals are very simple: energy is going to become dramatically cheaper. It’s terrible news for Saudi Arabia, Kuwait and Iran. But it’s great news for countries – like the UK – who are energy importers.

I’ve made no secret of my concerns about the impact of birth rates on the sustainability of developed world economies. But in the medium term, the next four to seven years, I really don’t think it matters. We are going to see a continued rippling effect from cheaper energy. There will be more pounds in people’s pockets from lower electricity and gas bills, there will be cheaper petrol, and there will be cheaper food, because the biggest input cost of food is nitrogen fertilizer (which is made with natural gas).

All of which means happier voters.

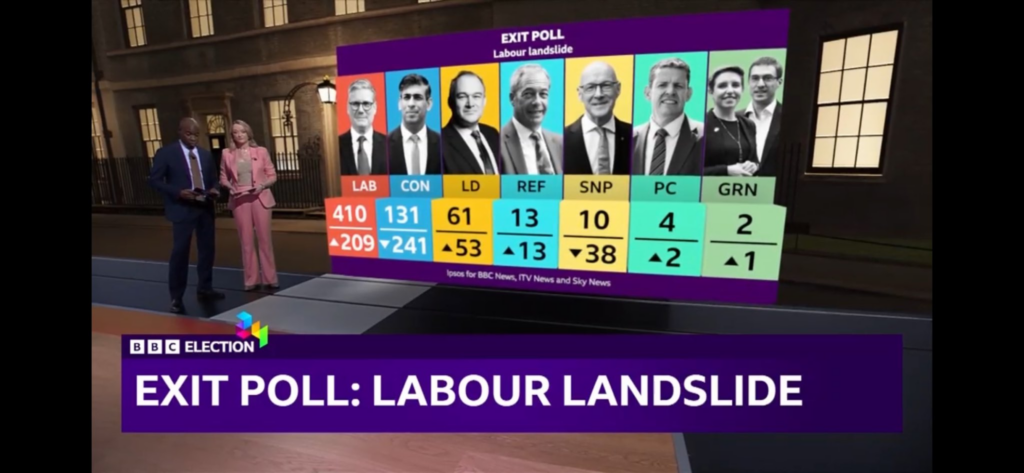

Starmer is a very lucky General.

Robert